One of the reasons has special appeal because it promises a free lunch.

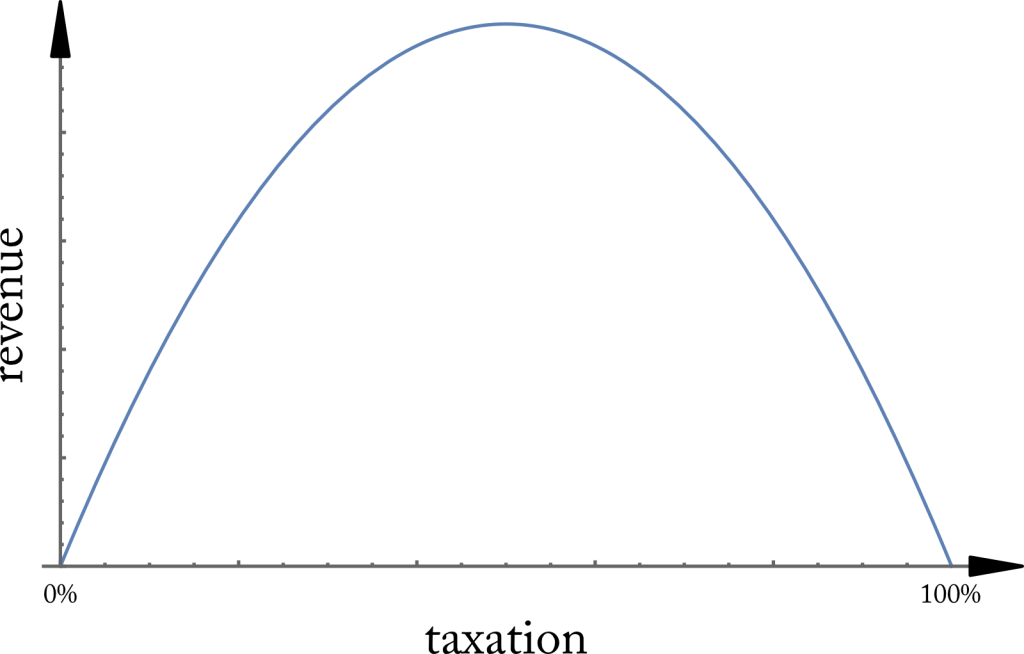

Imagine the two extremes of no taxation and of total taxation. In the case of no taxation the government will have zero revenue because nobody pays any taxes. The same is true in the case where everything is paid to the government. There is no incentive to do anything if you can not keep any of the proceeds. If you were to plot the government’s income as a function of the level of taxation you have a positive function that is zero at the two extremes of zero percent taxation and of hundred percent taxation. Assuming that you are dealing with a continuous function you now have the following fact: Every line parallel to the x-axis, i.e. every level of government income, intersects the curve at least twice. This means that there are always at least two levels of taxation that give rise to the same government income. Two not one.

The argument for lower taxation is then that the current level of taxation is the higher of the (at least) two levels of taxation. So the message of the curve is that you can lower the tax rate and not pay any price for it. You can built the same roads and bridges, maintain the same size military, and all of that with more money in everybodies pockets.

One might wonder, do Laffer like arguments exist in other areas of politics?

As a first example we look at health care. The basic argument is an argument about freedom. Here is Barry Goldwater in Conscience of a Conservative:

[…] the material and spiritual sides of man are intertwined; that it is impossible for the State to assume responsibility for one without intruding on the essential nature of the other; that if we take from a man the personal responsibility for caring for his material needs, we take from him also the will and the opportunity to be free. […]

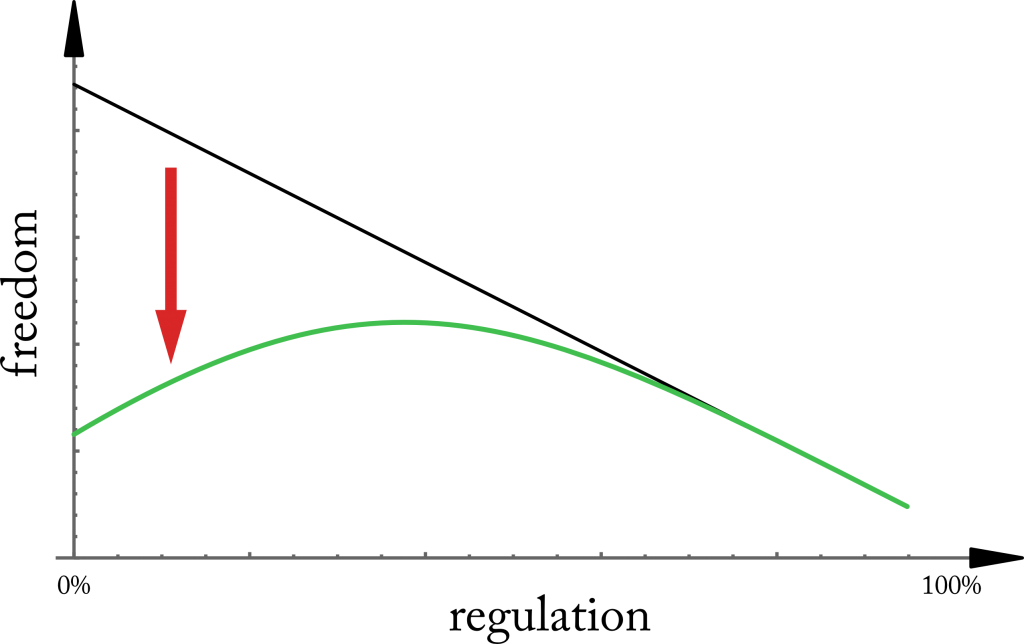

Let us then start to make a Laffer like argument. One of the extremes is simple. If we have total government control we will have very little freedom. Following Goldwater, the remedy is clear. Reduce government regulations and gain freedom in the process. This is much like in the case of taxation. The higher the taxation the more government income. Here we have, the higher the regulation, the fewer the freedoms.

To complete the argument we now have to ask: Did we neglect an important feedback? Did we forget an effect that destroys the linear relation between regulation and freedom?

Freedom becomes an abstract notion if your body has become a prison.

What is true for missing teeth is also true for numerous other medical problems that can hold a person back. Freedom becomes an abstract notion if your body has become a prison.

This effect changes the shape of the health care Laffer curve. Instead of decreasing, the curve actually increases when government regulations are added.

This type of reasoning can be repeated for gun control measures. Again, this is an argument about freedom. By restricting the right to own a weapon, gun legislation is seen as a restriction of your freedoms. The simple remedy is again the same. Remove regulations and gain freedoms.

As in the case of health care, though, there is a feedback that needs to be taken into account. If there are no regulations, it is your most basic freedom to live that might be severely imperiled. If anyone has the freedom to acquire any type of gun you might pay for that freedom with your life. In today’s America, that is the case for over 30.000 victims of gun violence each year. This number is an order of magnitude higher than in other developed nations, yet, the current political momentum is to further increase the freedoms of gun owners. Recently regulations have been rescinded that prevented mentally ill people to acquire weapons and a law is making its way through congress that will allow the use of silencers.

Sometimes, simple relations are just too simple to be true. The original Laffer curve deals with taxation but the thinking behind the curve can be applied much more broadly. Health care and gun control are just two concrete example. So, go ahead, use Laffer’s argument but don’t do it selectively. Laffer type feedback is what makes many political challenges so thorny and compromise so essential. Insist on simple dependencies and you might destroy the very thing you want to achieve.

© Olaf Dreyer

[1] Poor Cousin of the Middle Class, The New York Times, Jan. 18, 2004. (https://www.nytimes.com/2004/01/18/magazine/a-poor-cousin-of-the-middle-class.html)